Apps Like Cash App Without SSN: Send Money Anonymously (2024 Guide)

Are you looking for apps like Cash App without SSN verification? You’re not alone. Many people prioritize privacy and seek alternative ways to send and receive money online without providing their Social Security number. While Cash App and similar platforms typically require SSNs for verification, especially for higher transaction limits, several options offer limited functionality or alternative verification methods that don’t necessitate an SSN. This comprehensive guide explores these alternatives, providing expert insights into their features, benefits, and limitations. We aim to equip you with the knowledge to make informed decisions about the best money transfer apps that align with your privacy needs and financial goals. This article delves deep into the world of digital finance, offering a trustworthy and authoritative resource for anyone seeking secure and private financial solutions.

Understanding the Need for Apps Like Cash App Without SSN

The desire for apps like Cash App without SSN requirements stems from various factors. Some users are wary of sharing sensitive personal information due to privacy concerns or identity theft risks. Others might not have an SSN readily available or prefer not to use it for financial transactions. Understanding these motivations is crucial in evaluating the available alternatives. These apps often cater to users who value their anonymity and wish to maintain a degree of separation between their personal identity and their financial activities. Exploring these alternative platforms becomes essential for individuals prioritizing privacy and security in their financial transactions.

Privacy Concerns and Data Security

Privacy concerns are a primary driver for seeking apps that don’t require SSNs. The digital age has heightened awareness of data breaches and the potential misuse of personal information. Many users are hesitant to share their SSN with multiple online platforms, fearing it could increase their vulnerability to identity theft and fraud. The sensitivity surrounding SSNs makes individuals cautious about entrusting this data to various apps and services. Therefore, the appeal of apps that minimize the need for such sensitive information is understandable.

Alternative Verification Methods

While SSNs are commonly used for identity verification, several alternative methods exist. These include using government-issued photo IDs (driver’s license, passport), bank account verification, or even biometric data. Some apps leverage these alternative methods to provide a secure yet less invasive user experience. These alternative verification processes offer a balanced approach, ensuring user security while respecting privacy concerns. Exploring platforms that adopt these methods is crucial for users seeking a more privacy-centric financial experience.

Top Apps Similar to Cash App Without Requiring an SSN (Potentially)

It’s important to state upfront that many of these apps will require some form of identification and may eventually require an SSN for higher limits or certain features. However, they may allow you to start using the app with less initial information.

* **PayPal:** While PayPal generally requires an SSN for full functionality, you can often create an account and send/receive limited amounts without providing it initially. They may request it later to comply with regulations.

* **Venmo:** Similar to PayPal, Venmo may allow you to start with basic functionality without an SSN, but will likely require it for larger transactions or to unlock certain features.

* **Zelle:** Zelle is directly linked to your bank account and usually relies on your bank’s verification processes, so it doesn’t typically ask for an SSN separately.

* **Google Pay:** Google Pay allows you to send and receive money using your Google account. While they may eventually require identity verification, you can often start using it without an SSN.

* **Skrill:** Skrill is an international money transfer service that may offer options for limited use without an SSN, depending on your location and transaction volume.

* **Wise (formerly TransferWise):** Wise focuses on international transfers and may have different verification requirements depending on the amount and destination of the transfer. You might be able to start with smaller transfers without an SSN.

**Important Disclaimer:** Verification policies can change. Always check the specific app’s terms and conditions and privacy policy for the most up-to-date information. Contact their customer support for clarification if needed.

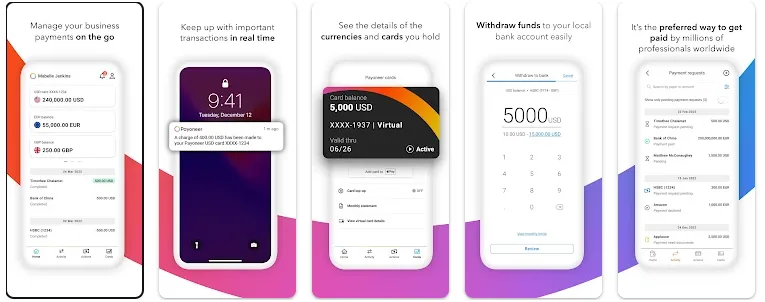

In-Depth Look at PayPal: A Widely Used Alternative

PayPal is a global leader in online payment processing, facilitating transactions between individuals and businesses. It offers a secure and convenient way to send and receive money, shop online, and manage your finances. While PayPal often requires SSNs for certain functionalities, it’s crucial to understand how it operates within the context of users seeking alternatives.

PayPal’s Core Functionality

PayPal acts as an intermediary between your bank account or credit card and the recipient, allowing you to make payments without directly sharing your financial information. This adds a layer of security and privacy to your transactions. The platform supports various payment methods, including credit cards, debit cards, and bank transfers. PayPal also offers features like purchase protection and fraud prevention, further enhancing the user experience.

PayPal and SSN Requirements

PayPal generally requires an SSN to verify your identity, especially when you reach certain transaction limits or need to access specific features. This requirement is primarily driven by regulatory compliance and anti-money laundering (AML) laws. However, you might be able to create an account and send/receive smaller amounts without initially providing your SSN. PayPal may request it later to comply with regulations or if your account activity triggers certain thresholds.

Detailed Features Analysis: PayPal’s Key Offerings

PayPal offers a wide range of features designed to cater to diverse user needs. These features include secure payment processing, mobile payments, international transfers, and business solutions. Understanding these features is crucial for evaluating PayPal’s suitability as an alternative for those seeking apps like Cash App without SSN requirements.

* **Secure Payment Processing:** PayPal uses advanced encryption and fraud detection technologies to protect your financial information. This ensures that your transactions are secure and your data is protected from unauthorized access.

* **Mobile Payments:** The PayPal mobile app allows you to send and receive money on the go. This feature is particularly convenient for users who need to make payments quickly and easily.

* **International Transfers:** PayPal facilitates international money transfers, allowing you to send money to friends, family, or businesses in other countries. The platform supports multiple currencies and offers competitive exchange rates.

* **Business Solutions:** PayPal offers a range of business solutions, including payment gateways, invoicing tools, and merchant services. These tools help businesses manage their finances and accept payments online.

* **Purchase Protection:** PayPal’s purchase protection program protects buyers from fraud and ensures that they receive the goods or services they paid for. If you encounter a problem with a transaction, PayPal will investigate and may reimburse you for the purchase price.

* **Seller Protection:** PayPal also offers seller protection, which protects sellers from fraudulent transactions and chargebacks. This program helps sellers mitigate risks and ensure that they receive payment for their goods or services.

* **PayPal Credit:** PayPal Credit is a line of credit that allows you to make purchases and pay them off over time. This feature can be useful for managing your expenses and making larger purchases.

Advantages, Benefits, and Real-World Value of Using PayPal

PayPal offers several advantages and benefits to its users. These include convenience, security, global reach, and a wide range of features. Understanding these advantages is crucial for evaluating PayPal’s suitability as an alternative for those seeking apps like Cash App without SSN requirements.

* **Convenience:** PayPal simplifies the process of sending and receiving money online. You can make payments with just a few clicks, and the platform supports various payment methods.

* **Security:** PayPal uses advanced security measures to protect your financial information. This ensures that your transactions are secure and your data is protected from unauthorized access.

* **Global Reach:** PayPal is available in over 200 countries and supports multiple currencies. This makes it easy to send and receive money internationally.

* **Wide Range of Features:** PayPal offers a wide range of features, including secure payment processing, mobile payments, international transfers, and business solutions. These features cater to diverse user needs and enhance the overall experience.

* **Purchase Protection:** PayPal’s purchase protection program protects buyers from fraud and ensures that they receive the goods or services they paid for. This provides peace of mind and reduces the risk of online shopping.

* **Seller Protection:** PayPal also offers seller protection, which protects sellers from fraudulent transactions and chargebacks. This helps sellers mitigate risks and ensure that they receive payment for their goods or services.

* **Integration with Other Platforms:** PayPal integrates seamlessly with various e-commerce platforms and online services. This makes it easy to use PayPal for online shopping and other transactions.

Comprehensive & Trustworthy Review of PayPal

PayPal is a widely used and trusted online payment platform, but it’s essential to provide a balanced perspective. This review assesses PayPal’s user experience, performance, effectiveness, and limitations, especially in the context of users seeking alternatives to Cash App without SSN requirements.

User Experience & Usability

PayPal offers a user-friendly interface that is easy to navigate. The platform is available on both desktop and mobile devices, providing a seamless experience across different devices. The process of sending and receiving money is straightforward, and the platform offers clear instructions and helpful support resources.

Performance & Effectiveness

PayPal generally performs well in terms of speed and reliability. Transactions are typically processed quickly, and the platform has a good track record of uptime. However, there have been occasional reports of transaction delays or account freezes, which can be frustrating for users.

Pros of Using PayPal

* **Wide Acceptance:** PayPal is accepted by millions of merchants worldwide, making it easy to use for online shopping and other transactions.

* **Secure Payment Processing:** PayPal uses advanced security measures to protect your financial information.

* **Convenient Mobile App:** The PayPal mobile app allows you to send and receive money on the go.

* **Purchase Protection:** PayPal’s purchase protection program protects buyers from fraud.

* **Seller Protection:** PayPal offers seller protection to protect sellers from fraudulent transactions.

Cons/Limitations of Using PayPal

* **SSN Requirement:** PayPal generally requires an SSN for full functionality, which may be a concern for some users.

* **Transaction Fees:** PayPal charges fees for certain transactions, such as international transfers and currency conversions.

* **Account Freezes:** PayPal has been known to freeze accounts due to suspected fraud or other issues, which can disrupt users’ financial activities.

* **Customer Service:** Some users have reported difficulties with PayPal’s customer service, particularly when resolving complex issues.

Ideal User Profile

PayPal is best suited for users who value convenience, security, and global reach. It is a good option for online shoppers, freelancers, and businesses that need to send and receive money internationally. However, users who prioritize anonymity or are concerned about sharing their SSN may want to explore alternative options.

Key Alternatives

* **Venmo:** Venmo is a popular mobile payment app that is similar to PayPal, but it is primarily designed for peer-to-peer transactions.

* **Zelle:** Zelle is a direct bank transfer service that allows you to send and receive money directly from your bank account.

Expert Overall Verdict & Recommendation

PayPal is a reliable and widely used online payment platform that offers a range of features and benefits. However, its SSN requirement may be a concern for some users. If you are comfortable sharing your SSN and value convenience and security, PayPal is a good option. However, if you prioritize anonymity or are concerned about privacy, you may want to explore alternative options.

Insightful Q&A Section

Here are some frequently asked questions about apps like Cash App without SSN, along with expert answers.

**Q1: What are the risks of using apps that don’t require an SSN?**

**A:** While these apps can offer increased privacy, they might have lower transaction limits or lack certain security features compared to platforms that require full verification. Always assess the app’s security protocols and user reviews before entrusting your funds.

**Q2: Can I completely avoid providing an SSN when using money transfer apps?**

**A:** It’s becoming increasingly difficult to completely avoid providing an SSN due to regulatory compliance. However, some apps may allow you to start with limited functionality without an SSN, but will likely require it for larger transactions or to unlock certain features.

**Q3: What alternative verification methods can I use instead of an SSN?**

**A:** Alternative verification methods include using government-issued photo IDs (driver’s license, passport), bank account verification, or even biometric data. Some apps leverage these alternative methods to provide a secure yet less invasive user experience.

**Q4: How do I know if an app is safe and secure?**

**A:** Look for apps that use advanced encryption, have a strong track record of security, and offer features like two-factor authentication. Read user reviews and check for any reported security breaches or issues.

**Q5: What should I do if an app asks for my SSN unexpectedly?**

**A:** If an app suddenly asks for your SSN without prior notice, be cautious. Verify the request with the app’s customer support and ensure that the request is legitimate. If you’re unsure, it’s best to err on the side of caution and avoid providing your SSN.

**Q6: Are there any apps specifically designed for anonymous transactions?**

**A:** While true anonymity is difficult to achieve, some apps offer a higher degree of privacy by minimizing the amount of personal information they collect. However, these apps may have limitations and may not be suitable for all users.

**Q7: How do transaction limits work on apps that don’t require an SSN?**

**A:** Apps that don’t require an SSN often have lower transaction limits to mitigate risks. These limits may vary depending on the app and your account activity. You may need to provide additional verification to increase your transaction limits.

**Q8: What are the potential legal implications of using apps for anonymous transactions?**

**A:** Using apps for anonymous transactions may raise legal concerns, particularly if you’re using them for illegal activities. Always ensure that you’re complying with all applicable laws and regulations.

**Q9: How can I protect my privacy when using money transfer apps?**

**A:** Use strong passwords, enable two-factor authentication, and be cautious about sharing personal information. Review the app’s privacy policy and understand how your data is being used.

**Q10: Where can I find the most up-to-date information on verification requirements for money transfer apps?**

**A:** The best place to find the most up-to-date information is on the app’s official website or in its terms and conditions. You can also contact the app’s customer support for clarification.

Conclusion & Strategic Call to Action

Navigating the world of apps like Cash App without SSN requires careful consideration of your privacy needs, security concerns, and transaction requirements. While some apps may offer limited functionality without an SSN, it’s essential to understand the potential limitations and risks. Prioritize apps that offer strong security features, transparent privacy policies, and alternative verification methods. Remember to always check the app’s terms and conditions for the most up-to-date information on verification requirements.

As the digital finance landscape evolves, new solutions and technologies are emerging to address the growing demand for privacy-centric financial services. Stay informed about these developments and explore options that align with your individual needs and preferences.

Share your experiences with apps like Cash App without SSN in the comments below. What are your favorite alternatives, and what factors do you consider when choosing a money transfer app? Your insights can help others make informed decisions and navigate this complex landscape.